Схема розділу

-

1.1. Audit, its purpose and tasks

1.2 Types of audit

1.3 Subject, objects and method of audit

Purpose: formation of students' basic theoretical knowledge and practical skills in the organization and methodology of auditing, organization of the work of an auditing firm and the work of auditors. -

Purpose: formation of knowledge about the organization of the work of an audit firm, its stages, familiarization with methodological options for conducting an audit, mastering the skills of quality control of the work of an audit firm and the work of auditors2.1 Organization of auditing activities in Ukraine

2.2 Organization of work of the audit enterprise

2.3 Methodological principles of audit

-

3.1 The procedure for developing audit plans and programs

3.2 The audit process, its stages and procedures

3.3 Audit procedures

3.4 Audit information supportPurpose: mastery of audit planning skills (plans and programs), familiarization with the sequence and content of financial reporting audit procedures, clarification of sources of information for conducting financial reporting audits

-

4.1 Purpose, objectives, tasks and stages of the audit of constituent documents

4.2 Purpose, objectives, tasks and stages of accounting policy audit

4.3 Audit of the company's own capital: the purpose, tasks, subject and object of the audit of operations with own capital, regulatory support for the audit and evaluation criteria, sources of information for the audit and typical errorsThe purpose of the audit of the constituent documents is to establish the compliance of the legal basis of the enterprise's functioning, specified in the Statute and other documents, with legislative and regulatory acts regulating the establishment and economic and financial activity of the enterprise.

-

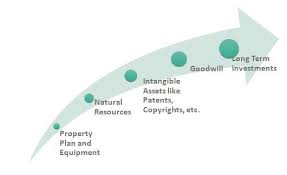

5.1 The purpose and tasks of the audit of non-current assets and financial investments

5.2 Subject and object of audit of non-current assets and financial investments

5.3 Legislative and regulatory support for the audit of non-current assets and financial investments

5.4 Information support for the audit of non-current assets and financial investmentsThe purpose of the audit of non-curent assets is to confirm the completeness of the information, the reliability, legality and correctness of the non-current assets accounting, as well as to establish the company's compliance with the requirements of P(s)BO 7 "Fixed Assets".

The main purpose of an investment audit is to form a reasoned opinion of the auditor about the reliability and sufficiency of information about them in the financial (accounting) statements of the economic entity being audited.

-

6.1 The purpose and main tasks of the audit of cash and receivables

6.2 Subject and objects of cash audit

6.3 Legislative and regulatory support for the audit of cash and receivables6.4 Sources of information for the audit of cash and receivables

-

The purpose is to learn the inventory audit methodology; acquire practical skills in planning an audit of inventory and forming working documents based on its results.

7.1 Purpose, tasks, subject and object of inventory and work-in-progress audit

7.2 Stages of inventory and work-in-progress audits and their content

7.3 Methodical approaches to checking stocks and work-in-progress

7.4 Legislative and regulatory and information provision of inventory audit and construction in progress -

8.1 Internal audit, its purpose, objects, functions and evaluation criteria

8.2 Planning the work of the internal auditor

8.3 Methods and methods of internal audit

8.4 Generalization of the internal auditor's work